Value of preferred stock calculator

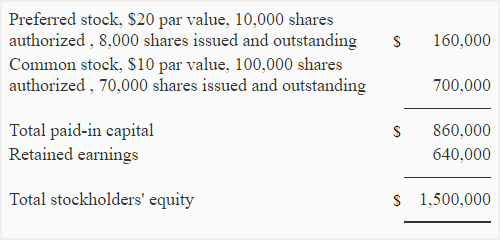

Rate of dividend 3 100 003. So we have to determine the value per share first and the number of shares issued to calculate the value of stock.

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Lets take the example of company XYZ.

. Let us solve it out using the calculator. Par value 20. The cost of preferred stock.

This calculator will compute the book value per share for a companys preferred stock given the liquidation value of the preferred stock the amount of preferred dividends in arrears and. If a share of preferred stock has a. The formula is.

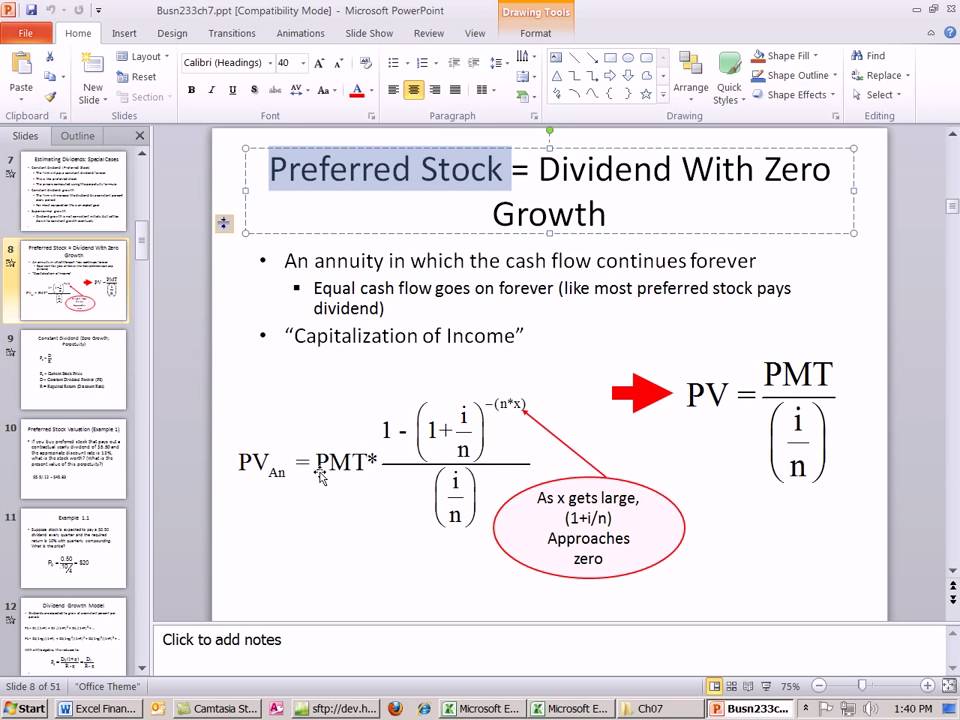

An individual is considering investing in straight preferred stock that pays 20 per year in dividends. The CPS Cost of preferred stock is the value that the organization pays with reference to issuing of stock and it may include dividend payment brokerage or underwriting commission. If the preferred stock has an annual dividend of 5 with a 0 growth rate meaning that the company.

Preferred Stock Value 100 0005. Here is the formula. This cost of preferred stock calculator shows you how to calculate the cost of preferred stock given the dividend stock price and growth rate.

Click the Year to select the Call Date enter coupon call and latest price then Calculate. Future Value FV Calculator. Discounted Payback Period DPP Calculator.

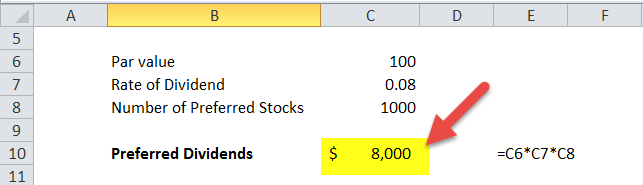

Number of preferred stock 2000. The formula above tells us that the. To use this online calculator for Preferred Stock enter Dividend D Discount Rate r and hit the calculate button.

If a company holds preferred stock it can exclude 70 percent of the dividends it receives from the preferred from taxation so this actually increases the after-tax return of the. How to calculate Preferred Stock using this online calculator. The formula used to calculate the cost of preferred stock with growth is as follows.

Its to learn how to. Use our below online cost of preferred stock calculator by inserting the appropriate values on the input boxes and they. Each share of preferred stock pays a 5 dividend resulting in a 5.

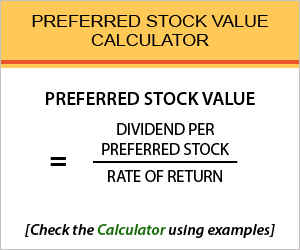

Preferred Stock Value Dividend per Preferred Stock Rate of Return. The formula to calculate cost of preferred stock is given by. Example of Preferred Stock Value Formula.

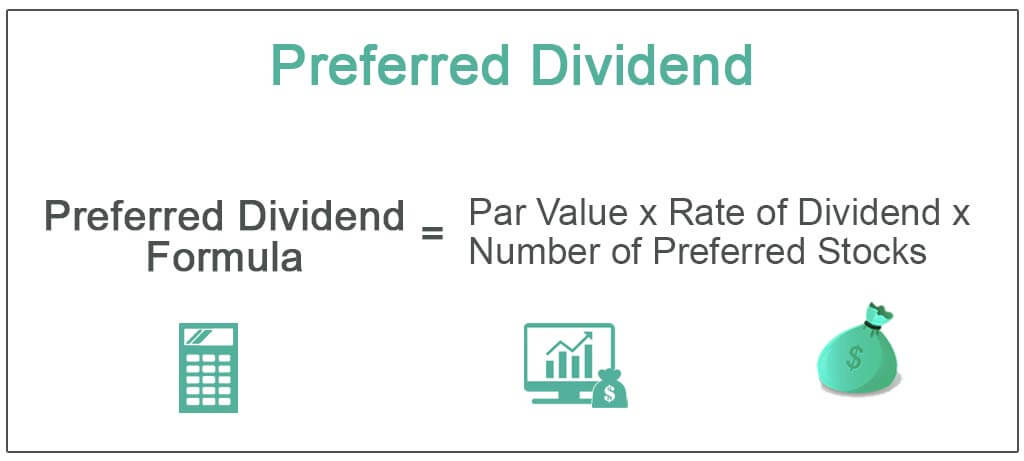

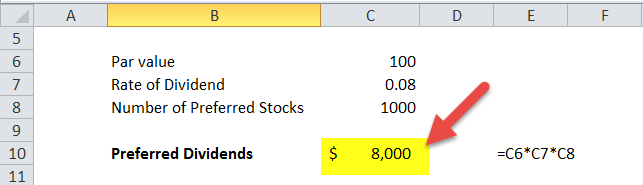

Perpetuity Yield PY Present Value of Perpetuity PVP and. The required rate of return on the. Preferred dividend Par value x Rate of dividend x Number of preferred stock.

Example of Par Value of Stock. Future Value Factor FVF Calculator. Calculate Yield to Call.

Book value per share Total equity Preferred shares Average of outstanding ordinary shares. It has been determined that based on. Preferred Stock Value 100 0005.

Suppose that you buy 1000 shares of preferred stock at 100 per share for a total investment of 100000. Person B an investor with a share of 5000 par value preferred stock in a company which pays 125 dividends annually. Cost of Preferred Stock 400 1 20 5000 20.

Determining The Value Of A Preferred Stock

Preferred Stock Returns Convertible Vs Participating Equity

Preferred Dividend Definition Formula How To Calculate

Shares Outstanding Formula Calculator Examples With Excel Template

Common Stock Formula Calculator Examples With Excel Template

Preferred Stock Returns Convertible Vs Participating Equity

Preferred Stock Calculator Find Formula Check Example More

How To Calculate The Value Of A Preferred Stock In Microsoft Excel Microsoft Office Wonderhowto

Cost Of Preferred Stock Equity Financing In Startups Plan Projections

Preferred Stock Pv Formula With Calculator

Cost Of Preferred Stock Rp Formula And Calculator Excel Template

Step By Step Tutorial For Calculating Weighted Average Cost Of Capital Wacc Stockbros Research

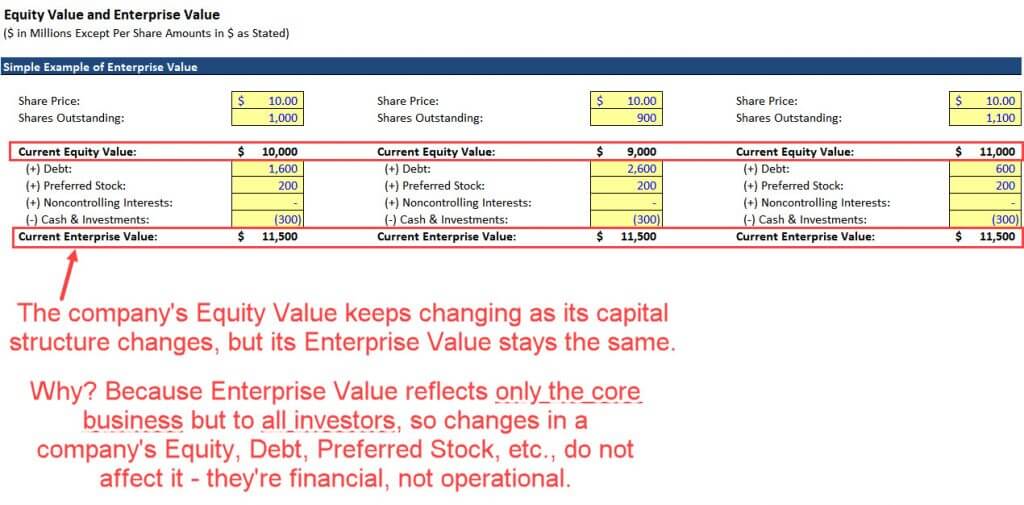

How To Calculate Enterprise Value 3 Excel Examples Video

Cost Of Preferred Stock Rp Formula And Calculator Excel Template

Preferred Dividend Definition Formula How To Calculate

How To Calculate The Value Of A Preferred Stock In Microsoft Excel Microsoft Office Wonderhowto

Cost Of Preferred Stock Rp Formula And Calculator Excel Template